There are three avenues of opportunity: events, trends and conditions

Sun Tzu, “The Art of War”

Trend followers have been among the most successful investors since the 1970s. Commodities Trading Advisors (CTAs), investment funds that tend to rely on systematic trend following have delivered stellar performance and sustained it, in many cases for decades. As a strategy, trend following may well be the only valid approach to navigating uncertainty in global securities markets.

The very gurus of value investing – Benjamin Graham and Warren Buffett – owed their outperformance entirely to trend following or momentum investing (see the article, “Value Investing vs. Trend Following: Which Is Better?”).

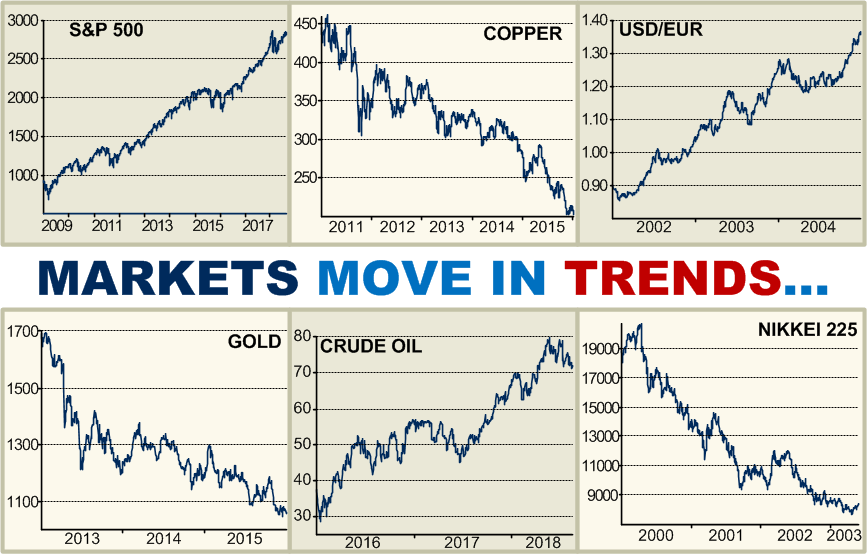

Markets move in trends

In the short term, market price fluctuations appear to be driven by news events and data. However, large-scale price events (LSPEs) invariably unfold as trends that can span many months and years.

Market trends provide us the opportunity to capture windfall profits by implementing systematic trend-following strategies which help us gauge our directional exposure to markets and the timing of buy and sell decisions.

How trend following works

Conceptually, trend following is a simple strategy: it entails buying assets whose prices are rising and selling those whose prices are falling. But the strategy can be very challenging to put into practice successfully. For one thing, it is counterintuitive: while we are naturally inclined to buy low and sell high, trend following entails the opposite: buying securities after their prices have risen for some time and selling them as prices decline.

Pre-requisite: discipline and patience

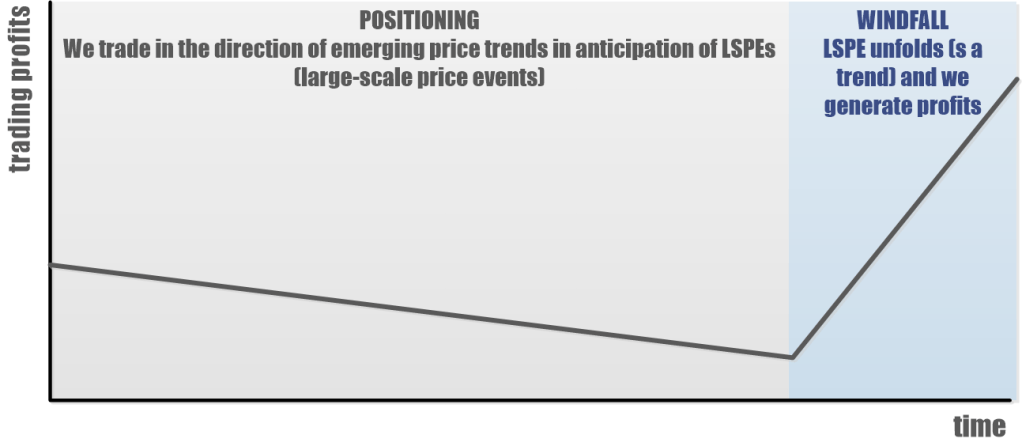

Another challenge is that trend following requires a great deal of patience and discipline. Schematically, the performance of trend following strategies over time might look like this:

We can’t predict when a trend might unfold; we also can’t predict how long it will last or how high or how low the price might reach. Instead of trying to make those predictions, we simply react to price fluctuations as they unfold and position our risk accordingly.

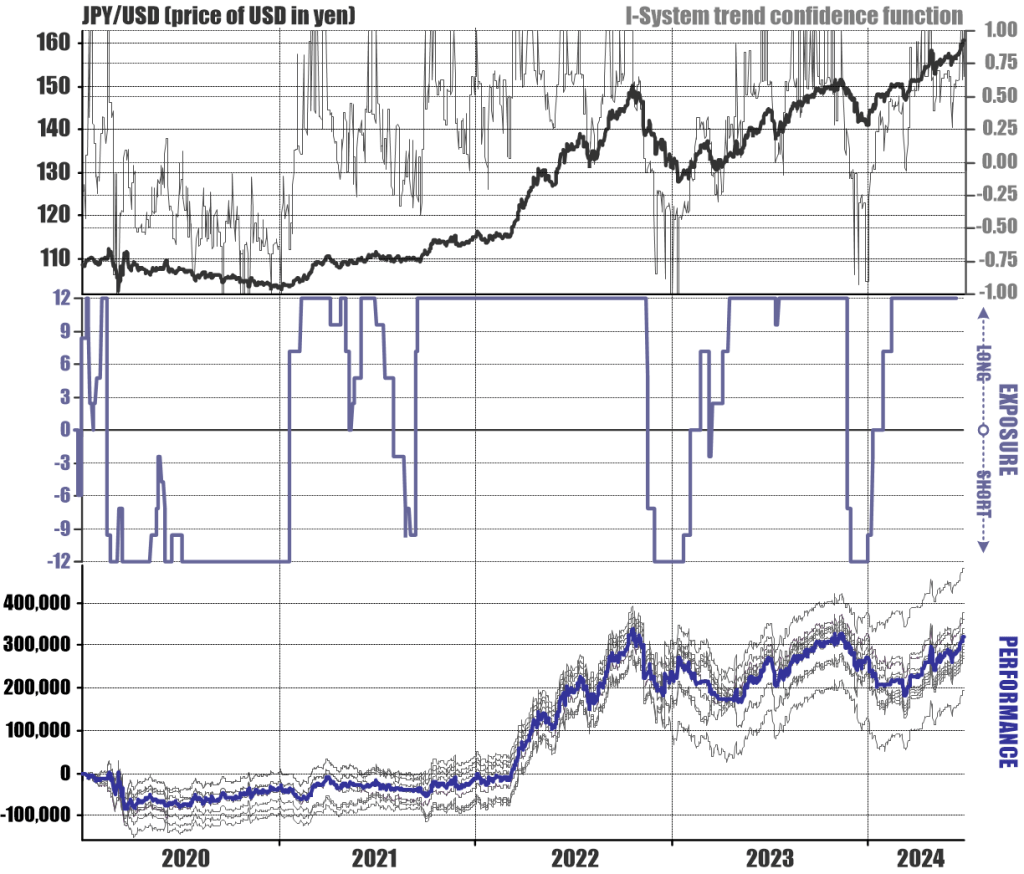

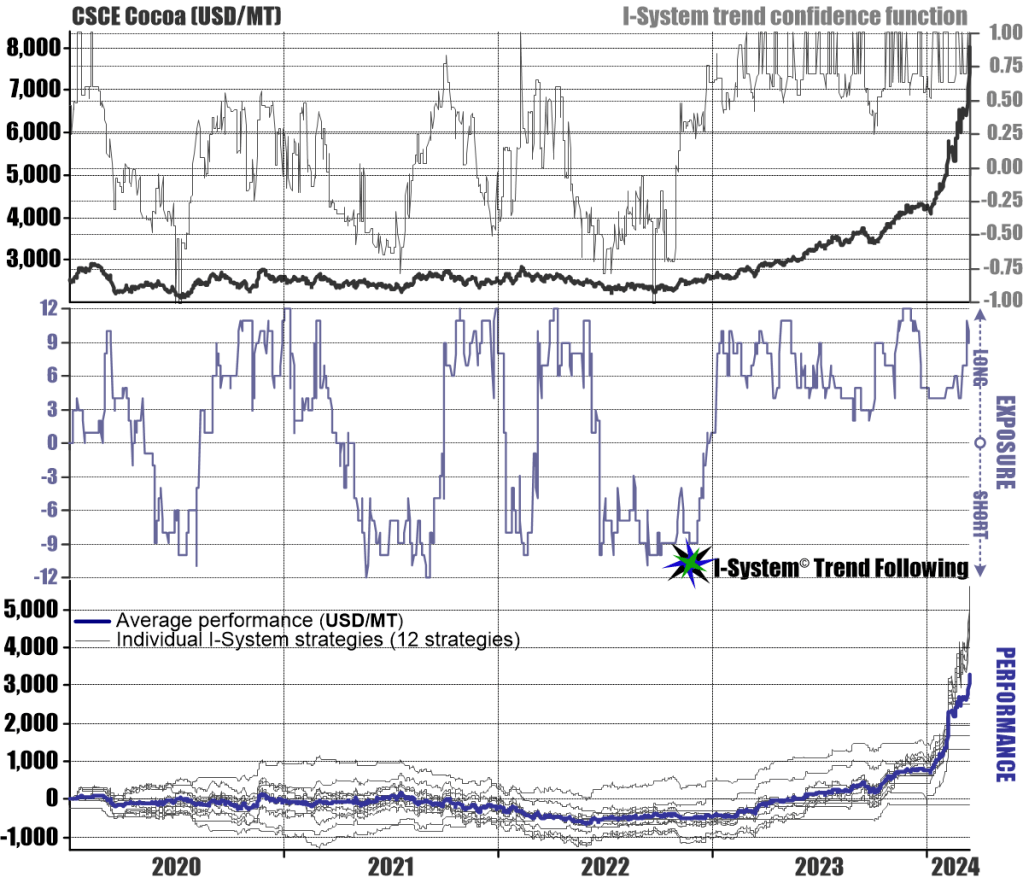

Trend followers believe that markets trend about a third of the time and spend about two thirds correcting and consolidating. Broadly, we believe this is correct. The charts below show a few real-life examples of the performance of our own strategies in different markets:

The top panel of the chart shows the price of US dollar in yen (left scale) overlaid with the I-System trend confidence function (right scale). Trend confidence fluctuates between 1 (certainty that we’re in an uptrend) and -1 (certainty that we’re in a downtrend). The middle panel shows net exposure generated by the 12 selected strategies (at -12 we’re 100% short the US dollar against the yen; and at 12 we’re 100% long). The bottom panel shows the strategies’ performance in yen, each trading a single 5 million yen position.

A similar chart shows our performance trading CSCE Cocoa futures:

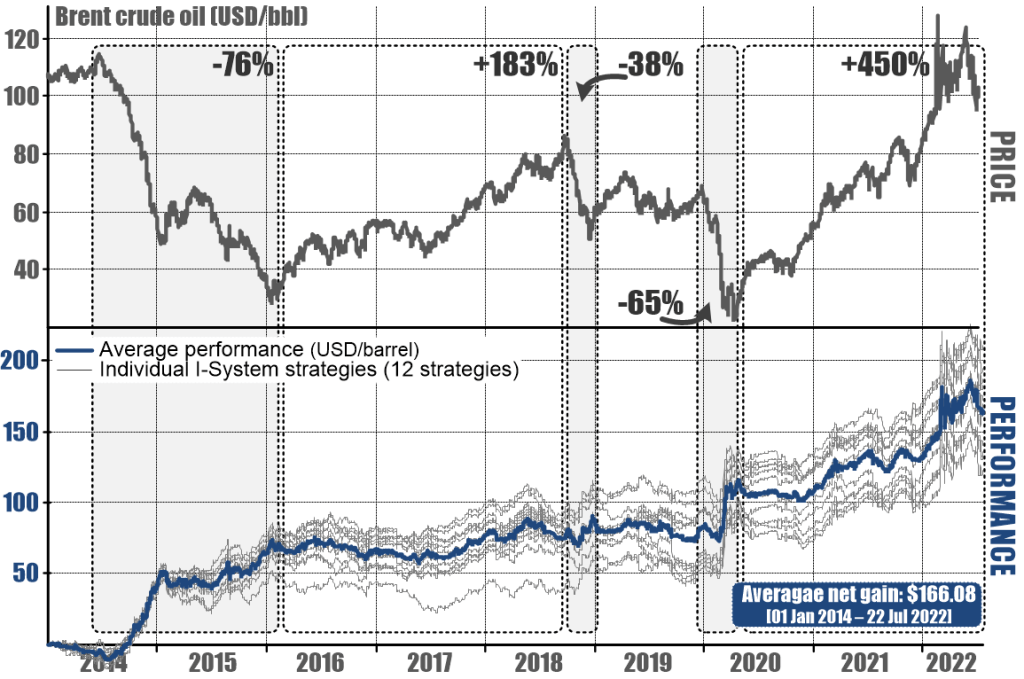

In both charts we can see the usual experience with trend following: long periods of trendless price fluctuations give way to LSPEs which tend to unfold suddenly and seemingly out of nowhere. The months and years of disciplined and patient positioning for that events usually pay off multifold. It’s what trend followers refer to as sequences of feast and famine. However, the “famines” don’t always last as long as in the above examples – we only show those to illustrate the need for discipline and patience. The next chart shows our performance in Brent crude oil futures from 2014 to 2022:

The shaded areas highlight large-scale price events and also underscore one of the greatest advantages of trend following: the ability to generate profits both in bull and bear markets.

Trend following is like fishing

Indeed, you can think of trend following as fishing: imagine that you have a small fishing boat and you specialize in catching tuna. You know that large schools of tuna pass nearby from time to time and when they do, you can land a large catch. But you don’t know when that might be and to catch them you must go out to sea and cast your nets every day.

This entails risk and costs you some effort and expense. However, you expect that you’ll recover all this when you land the next large catch. Likewise, to capture profits from a large price move you need to continually position your bets in direction of the anticipated trend.

No pain, no gain

Trends don’t announce themselves in advance. In fact, LSPEs (large-scale price events) are by definition unpredictable. To profit from them we need to be in the right position at the right time and this positioning involves risk-taking and incurring some losses until the trend takes off. This is precisely what the above charts illustrate.

But what the charts can’t convey is the psychological aspect of the process: taking positions and having flat performance, or sustaining losses for months is difficult for even the most disciplined of traders, especially as we never know when a trend might emerge and redeem our losses. Regardless, this is what the process entails: not taking risks would be the equivalent of failing to cast our nets the day when a large school of tuna passes within our reach.

Isn’t there an easier way?

We’d all like to find some gimmick giving us instant trading gratification and predictable profits without much risk of losses. This desire is met with a flood of offers promising very large returns on investment, risk-free trading, 80% accurate forecasts, etc. Such claims will usually prove false. We know that most speculators lose money. In some jurisdictions, retail brokers are obliged to disclose the percentage of their customers who lose money. Here are a few such disclosures:

- ETX Capital: 75.6% lose money

- IG Group: 74% lose money

- Ava Trade: 71% lose money

- Plus 500: 76% lose money

QUANT CONTESTS: 79% LOSE MONEY

One company’s experience provides a valuable empirical case: in December 2006, world’s most popular trading platform provider MetaQuotes organized an Automated Trading Competition.

The $80,000 prize attracted 258 developers of quantitative strategies. More of them joined over the following six years and through 2012, MetaQuotes’ challenge attracted a total of 2,726 participants – all highly motivated to win the prize and sophisticated enough to formulate and test quantitative strategies they hoped would win the competition.

However, only 567 (21%) of them finished their competitions in the black while all others – 79% of them, lost money.[1] This data speaks to the unrealistic claims of many providers of quantitative systems: they all look great on paper but usually prove less useful in reality.

How is trend following different?

Trends are the product of human psychology and the collective action of market participants. Our psychology is the one constant in all markets that’s not likely to change any time soon, which is why we can observe price trends in any market throughout history.

Here’s how the trending dynamic emerges: in making investments, our rational goal is to obtain the best possible return with the least risk necessary. If we buy some asset, we want to receive a stream of rents or dividends and have the opportunity to sell that security for a higher price than what we paid. Since those outcomes depend on other market participants, we are obliged to reflect on what they might do. Thus, if the price of some asset is rising, we may conclude that it is attractive to other investors, and that the rising demand would push prices even higher.

Informed by the actions of others, we might accept inflated asset prices and proceed with the investment anyway. In one form or another, this dynamic is at work in every market where people speculate and transact – it is simply a matter of human nature.

Risk taking: a matter of belief and necessity

The belief: ultimately, the justification in any risk-taking rests on a belief. The fisherman’s endeavor is warranted by his belief that tuna will periodically pass within the reach of his nets. For the trend follower, the belief is that markets move in trends.

The necessity: The willingness to take risks is ultimately motivated by necessities of life. Fishing is necessary as a source of sustenance for the fisherman and his customers. Trading is predicated on the necessity to generate return on one’s capital, including cash. If cash is idle, it predictably loses purchasing power over time.

The need to keep capital working productively was perhaps best captured by St. Thomas Aquinas when he said that, “If the highest aim of a captain were to preserve his ship, he would keep it in port forever.” Of course, people do not build ships in order to preserve them, but to put them to work. The same is true for other forms of capital.

Speculation is inevitable

Productive use of capital inevitably involves speculation, as do many ordinary decisions in life: do I buy a home, or do I rent? Do I get a job after school or do I go to university? Should I keep my job or start a business? Shall I save up to buy a tractor in cash, or do I lease it without delay? To the extent that such decisions deal in the present with uncertain future outcomes, they are speculative.

But more controversial aspects of speculation emerge when we engage in financial transactions for profit. The desire to gain in such transactions intensifies the emotional experiences like fear and greed and often leads to unfortunate outcomes. To avoid this, it is essential that we moderate our actions with judicious risk management and unwavering discipline.

Finally, taking the systematic approach to ensure that we can venture forward with a disciplined adherence to predefined and tested decision-making rules.

Real solutions start here!

For those investors and traders who would like to learn more about trend following or implement it in practice, I-System Trend Following offers a range of solutions:

- Bespoke managed accounts through our partner organizations,

- Turn-key portfolio solutions for professional investment managers

- Daily TrendCompass newsletter for traders, hedgers and investors – whether professional or otherwise.

Learn more by visiting our “SOLUTIONS” page.

[1] Robson, Ben. “Currency Kings” – McGraw-Hill Education, 2017.