It has long been my contention that in securities markets, prices lead and narratives follow, as I summed up in this 2016 article: “Market facts vs. market narratives.” Yesterday we had another case in point: the price of Crude Oil rallied and the media rushed a slew of articles and commentary explaining the move.

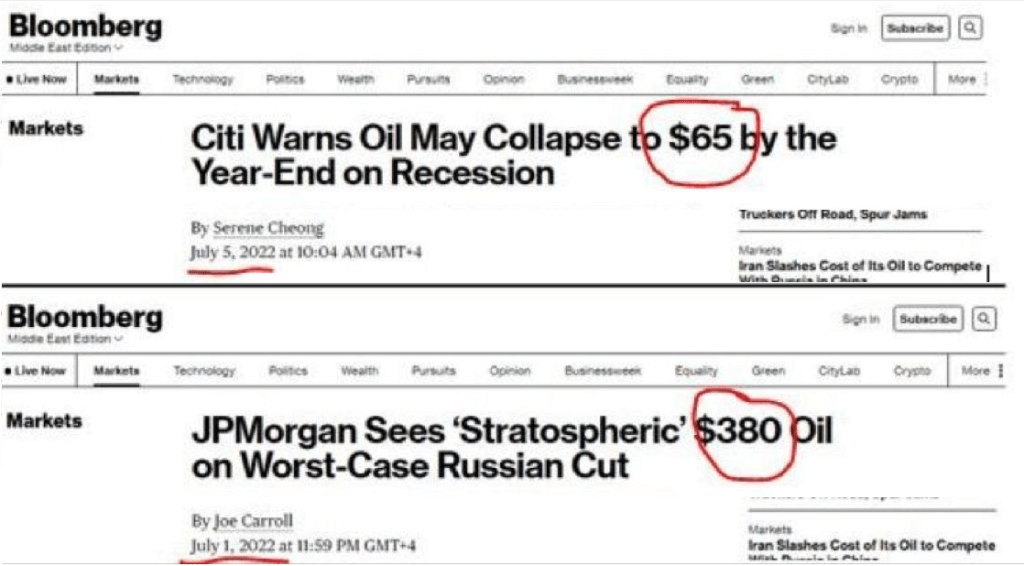

ZeroHedge headline read, “US Shale Giant Agrees With JPMorgan: Oil Headed For $150.” Without a doubt, had the price of Crude Oil crashed, we’d have a slew of articles and commentary explaining all the reasons why that had happened. It calls to mind these two articles, published by Bloomberg on the same week last summer and showing a very different forecast from JPMorgan:

So, oil is going to $65, or $150, or $380… Other analysts still called for Crude Oil going to $20-handle, and let’s not forget Cathy Wood‘s genius 2020 forecast for oil at $12/bbl. All these predictions were duly reasoned by learned analysts working diligently at their great big market institutions armed with all the information money can buy. Given the broad range of all these forecasts, someone will prove right and they’ll probably be ushered before the viewers at CNBC, Bloomberg and other media to talk about how they knew… Next, we’ll read about “the analyst who predicted bla, bla.. who now says that, bla, bla, bla…”

There has got to be a better way!?

This kind of thing has been going on forever, but from an investor’s point of view, it’s all worth less than zero. As an oil market analyst in the 1990s, after about three years of following many market experts, I realized that this kind of guidance was worthless, which led me to develop a quantitative trading approach based on systematic trend following.

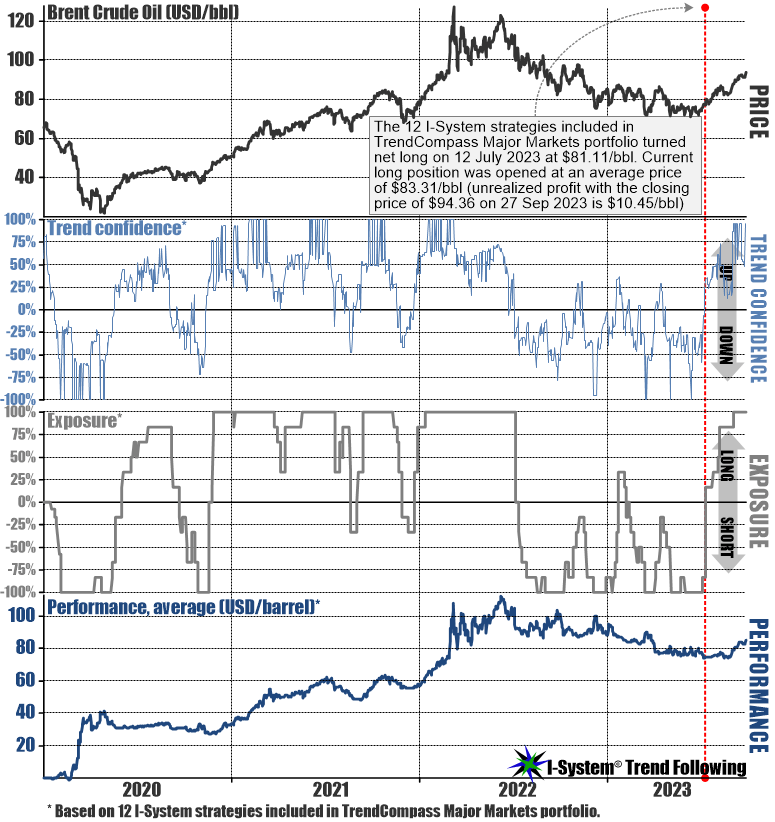

Here’s how the 12 Crude Oil strategies included in our Major Markets portfolio have performed, basing the trading decisions exclusively on Brent’s price fluctuation dynamics, without any sort of prediction involved:

It’s a busy chart for sure, but what it shows is the price of Brent Crude Oil contract, I-System’s trend confidence function, our exposure based on the 12 strategies, each trading a single contract of Brent Crude, and the trading performance of these signals.

The current positioning…

We switched from net short to net long on 12 July when Brent closed at $81.11 and added to a full long position at an average price of $83.91 for an unrealized gain through last night’s closing price of $10.45/barrel. Also, please note that trend following includes deep and long drawdowns, which is why I repeatedly drum on the need for patience and discipline.

With respect to our current (unrealized) gain, it might grow, or it might vanish, depending on future price fluctuations, which we cannot predict. Perhaps the price of the barrel goes to JPMorgan’s target of $150, or JPMorgan’s other target of $380, who knows. Or perhaps it goes to Cathy Wood’s $12.

The point is that markets move in trends and that large-scale price events represent the most powerful driver of investment returns. A disciplined, patient adherence to a set of tried-and-tested rules offers more sustainable, more reliable guidance to markets than expert forecasts can, which is the whole raison d’etre behind I-System Trend Following and the TrendCompass newsletter.

Sign up for a 1-month free trial of I-System TrendCompass!

One of the best trend following newsletters on the market, I-System TrendCompass delivers consistent, dependable and effective decision support daily, based on I-System trend following strategies covering over 200 key financial and commodities markets with no dilution in quality or focus.

- Cut the information overload

- Get real-time CTA intelligence in seconds per day

- Never miss a major trend move

- Navigate trends profitably, with confidence and peace of mind

One month test-drive is always on us. Sign up for a 1-month FREE trial by e-mailing us at TrendCompass@ISystem-TF.com

To learn more, please visit I-System TrendCompass page.